Bitcoin ETFs Experience Historic Outflow of $680 Million

Financial writer covering the latest trends in global economics and cryptocurrency.

Financial writer covering the latest trends in global economics and cryptocurrency.

Here's a news post about the recent Bitcoin ETF outflows:

Key Takeaways:

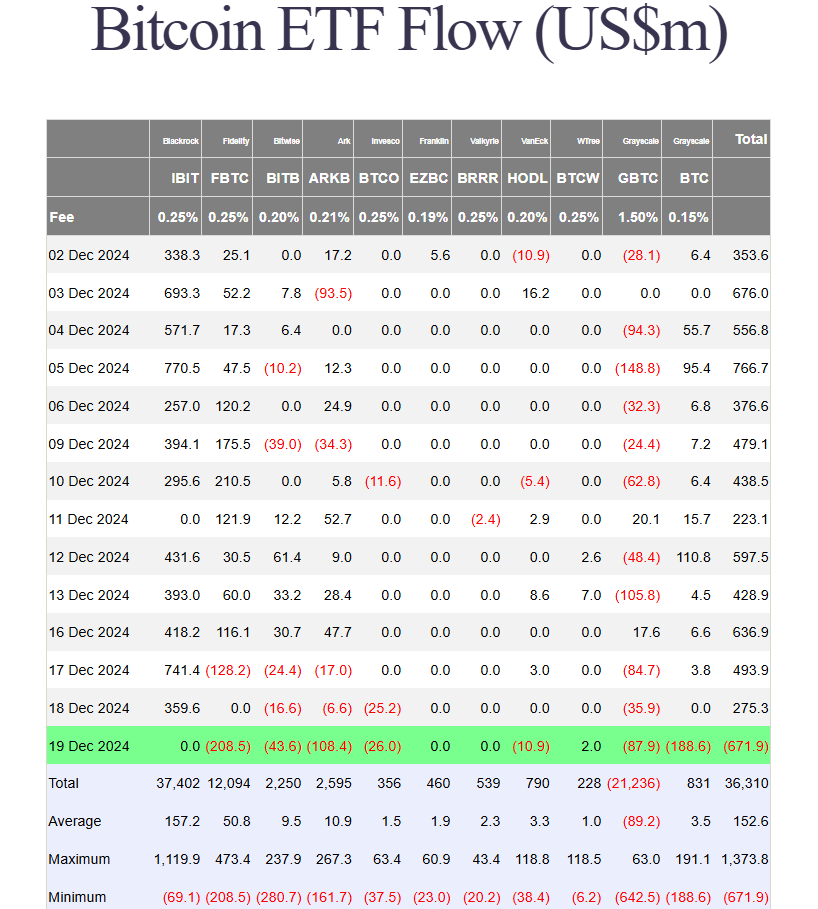

On December 19, 2024, U.S. spot Bitcoin ETFs experienced their largest single-day outflow since their launch, totaling a massive $680 million. This significant outflow brought an end to a 15-day streak of consecutive inflows, according to Spot On Chain. This event has sparked discussions about the current sentiment within the cryptocurrency market.

Fidelity's FBTC saw the most significant outflow, with investors withdrawing $208.55 million. Grayscale's mini BTC ETF followed with $188.6 million, and ARK Invest's ARKB ETF saw $108.35 million in outflows. The previous record outflow was set in May with a $563 million outflow.

Interestingly, BlackRock's IBIT ETF reported no significant net inflows or outflows. This indicates that the market's volatility might not have impacted every product in the same way. WisdomTree's BTCW bucked the trend, recording $2 million in inflows.

Ethereum ETFs also experienced outflows, totaling $60.47 million. This ended an 18-day streak of inflows. Grayscale's ETHE lost $58.13 million, and Bitwise's ETHW saw $6.78 million in outflows.

Several factors may have contributed to this sharp decline in Bitcoin ETF inflows. Bitcoin's price volatility could have influenced investor sentiment. Bitcoin's price dropped by 4.22% in the last 24 hours.

After reaching significant price milestones, like breaking the $100,000 mark, some investors may have decided to lock in profits, as noted in our recent post on Bitcoin breaking $100K. Additionally, macro-economic concerns and potential regulatory uncertainty may have played a role.

This outflow could reflect short-term market anxiety. However, Bitcoin's long-term fundamentals remain strong. Institutional interest continues to play a significant role in its ecosystem. The market will be closely watching to see if this trend continues. It will be interesting to see if this is a temporary blip or a broader shift, as discussed in our analysis of a potential market correction after Bitcoin's $106K record.

— in Cryptocurrency

— in Cryptocurrency

— in Cryptocurrency

— in Cryptocurrency

— in Cryptocurrency