Key Trends in Blockchain Integration within Financial Systems

Overview of Blockchain's Role in Finance

Blockchain technology is revolutionizing the financial sector. It offers a decentralized, secure, and transparent ledger system.

This technology enhances security, reduces fraud, and streamlines transactions. It is transforming traditional financial operations.

Current State of Blockchain Adoption in Banking

Many banks are exploring blockchain. They are investing in pilot projects and partnerships to integrate this technology.

By the end of 2022, the global blockchain technology market size was estimated at $10.02 billion and is expected to reach $3.1 trillion by 2030. As blockchain becomes more mainstream, its adoption in banking will accelerate, leading to significant improvements in efficiency and security.

Latest Trends in Blockchain Integration in Financial Systems

Interoperability Solutions for Financial Institutions

Interoperability is crucial for blockchain adoption. Solutions that allow different blockchain networks to communicate are emerging.

Cosmos Network and Polkadot are leading examples. They enable seamless data exchange between various blockchains, enhancing functionality and creating an interconnected ecosystem.

Rise of Blockchain as a Service (BaaS)

BaaS is gaining traction. It allows businesses to use cloud-based solutions to develop, host, and use their blockchain apps.

Companies like Microsoft and Amazon offer BaaS. This simplifies blockchain adoption, making it accessible to more businesses without the need for extensive infrastructure.

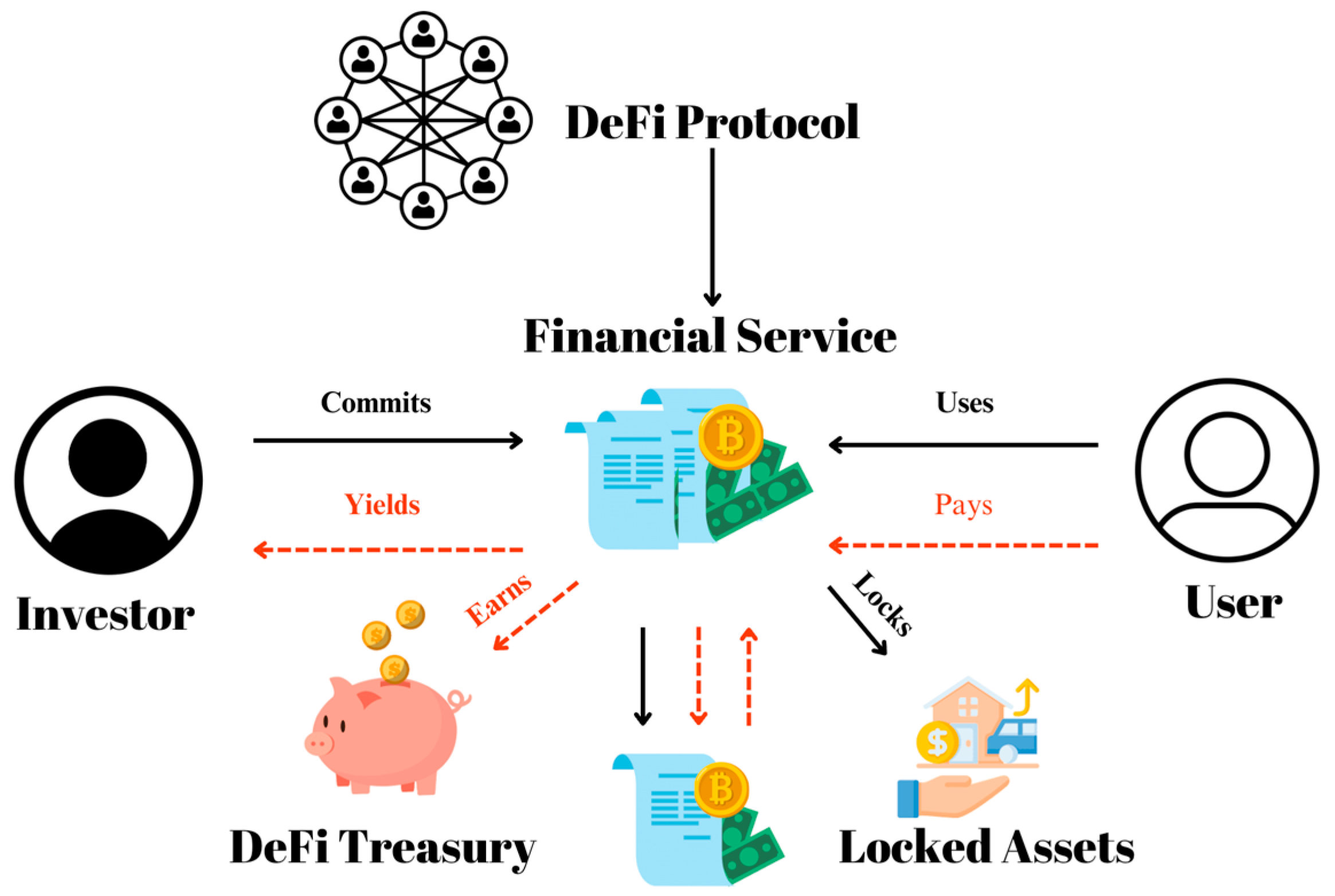

Decentralized Finance (DeFi) Innovations

DeFi is transforming finance by removing traditional intermediaries. It offers services like lending, borrowing, and trading on the blockchain.

DeFi has grown into a $200 billion industry as of 2024, according to DeFi Pulse. Platforms like Uniswap and Aave are driving user adoption, and 65% of top-tier banks plan to incorporate DeFi capabilities by 2025, according to a study by Deloitte.

Impact of Blockchain on Financial Services in 2024

Enhancements in Cross-Border Transactions

Blockchain is streamlining cross-border payments. It reduces transaction times and costs by eliminating intermediaries.

Ripple and Stellar are examples of blockchain-based payment systems. The World Bank estimates that such systems have reduced transaction costs by an average of 40% for small and medium-sized enterprises (SMEs).

Tokenization of Assets and Its Implications

Tokenization converts real-world assets into digital tokens. This makes high-value assets accessible to a wider pool of investors.

The global tokenization market is valued at $1.7 trillion in 2024. Platforms like RealT and Propy have seen a 200% increase in user engagement, particularly among younger investors interested in real estate.

Central Bank Digital Currencies (CBDCs) and Their Adoption

CBDCs are digital currencies issued by central banks. They offer the benefits of digital currency with the stability of government backing.

Over 130 countries are exploring CBDCs. China's digital yuan transactions reached $100 billion in 2023, showcasing the potential of CBDCs.

Challenges of Integrating Blockchain in Finance

Regulatory Compliance and Legal Frameworks

Regulatory uncertainty is a major challenge. Different countries have varying regulations, making it difficult for banks to adopt blockchain globally.

Banks need to collaborate with regulators to create clear guidelines. Staying informed about regulatory changes is crucial for compliance.

Data Privacy and Security Concerns

Data privacy is paramount in finance. Blockchain's transparency can conflict with privacy regulations like GDPR.

Banks can use permissioned blockchains and cryptographic techniques like zero-knowledge proofs. These methods protect sensitive data while maintaining transparency.

Technological Barriers to Adoption

Scalability is a significant issue. Blockchain networks can become slow and inefficient as transaction volumes increase.

Banks can explore hybrid solutions and Layer 2 scaling options. Collaborating with blockchain developers to innovate new technologies can address these challenges. Integrating blockchain with existing systems can also be complex, requiring careful planning and execution to avoid disruptions.

Future of Blockchain in Payment Systems

Predictions for Blockchain in Finance by 2025

Blockchain's influence will continue to grow. It will become more integrated with emerging technologies like AI and IoT.

The global blockchain market in finance is expected to reach $80 billion by 2026. This growth indicates a robust outlook for blockchain adoption in the financial sector.

The Role of Emerging Technologies: AI and IoT Integration

AI can enhance blockchain by analyzing transaction data for fraud detection. IoT devices can improve asset tracking in supply chain finance.

This integration will create more secure and efficient financial systems. The combination of these technologies will drive innovation in the financial sector.

Potential for Sustainable Blockchain Practices in Finance

Sustainability is becoming a focus. Ethereum's shift to Proof of Stake (PoS) has drastically reduced energy consumption.

Sustainable practices will become standard. This shift will address environmental concerns and enhance the reputation of blockchain technology in finance. The move towards greener blockchain solutions will attract environmentally conscious investors and users.

Key Takeaways:

- Interoperability solutions are enabling seamless communication between different blockchain networks, enhancing functionality.

- BaaS is simplifying blockchain adoption by providing cloud-based solutions, making it accessible to more businesses.

- DeFi is revolutionizing finance by offering decentralized services, with significant growth and adoption by major banks.

- Tokenization and CBDCs are transforming asset management and digital currencies, providing new opportunities for investors.

- Regulatory compliance, data privacy, and technological barriers remain significant challenges, requiring innovative solutions and collaboration with regulators.

This structure ensures a comprehensive exploration of blockchain integration in financial systems, addressing current trends, impacts, challenges, and future outlooks while optimizing for relevant keywords.