Understanding Bitcoin Halving

What Is Bitcoin Halving?

Bitcoin halving is a pivotal event in the Bitcoin network that occurs approximately every four years. It reduces the reward for mining new blocks by half, effectively controlling the supply of Bitcoin in circulation. Originally, miners received 50 BTC for each block mined; this reward has decreased over time, with the most recent halving on April 19, 2024, reducing the block reward to 3.125 BTC. This mechanism is critical for maintaining Bitcoin's deflationary nature and scarcity.

Historical Context of Bitcoin Halving Events

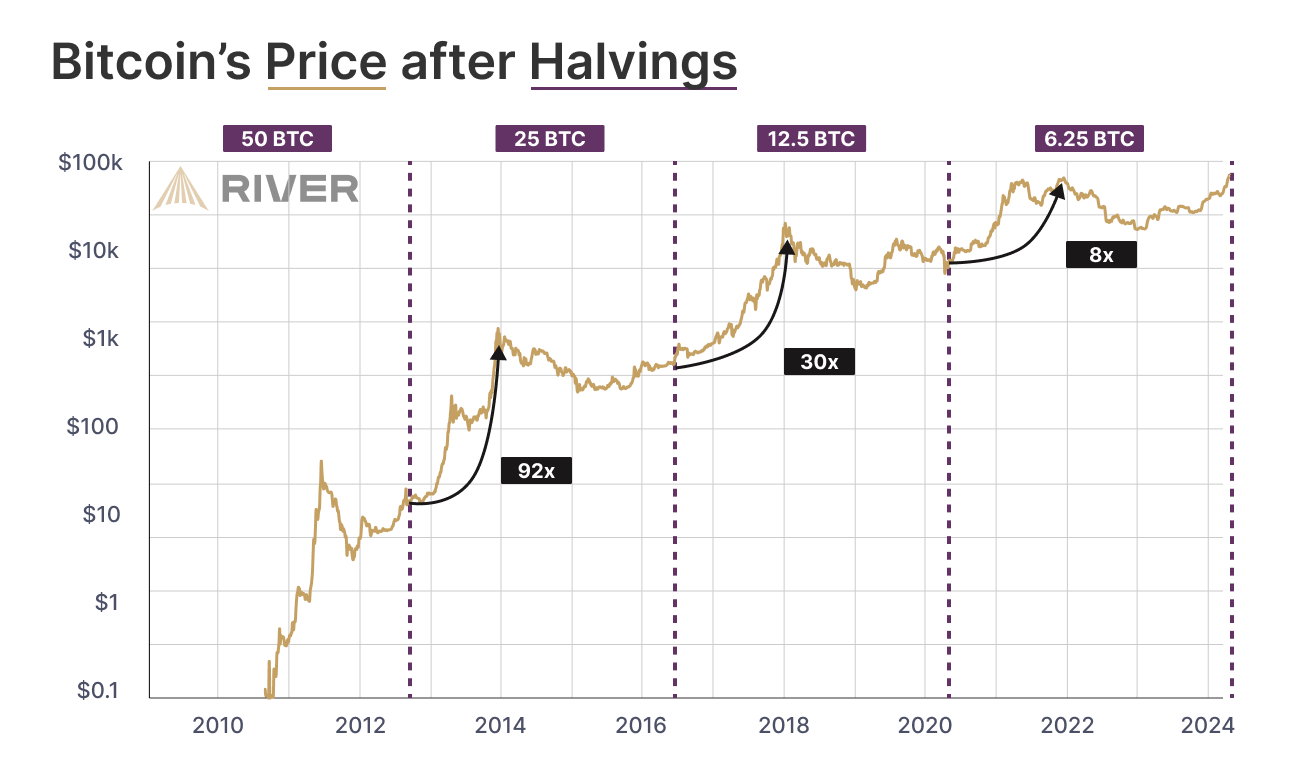

Since Bitcoin's inception in 2009, there have been four halving events:

- First Halving: November 28, 2012, decreased the reward from 50 BTC to 25 BTC.

- Second Halving: July 9, 2016, reduced the reward to 12.5 BTC.

- Third Halving: May 11, 2020, cut the reward to 6.25 BTC.

- Fourth Halving: April 19, 2024, slashed the reward to 3.125 BTC.

These events have historically had significant implications for Bitcoin's market dynamics and price volatility.

How Bitcoin Halving Affects Price Changes

Immediate Price Reactions Post-Halving

Historically, Bitcoin’s price tends to experience a surge in the months leading up to and following a halving event. For instance, leading up to the most recent halving in April 2024, Bitcoin's price rose significantly, reflecting heightened investor interest and speculation. This pattern suggests that many traders anticipate the supply shock caused by halving, which often leads to increased buying activity.

Long-Term Price Trends Following Halvings

The long-term effects of halving events are even more pronounced. Bitcoin has typically seen substantial price increases within 12 to 18 months post-halving. For example, after the second halving in 2016, Bitcoin's price surged from around $660 at the time of halving to nearly $20,000 by December 2017. Similarly, the third halving in 2020 saw Bitcoin rise from about $9,700 to an all-time high of over $64,000 in 2021.

Historical Bitcoin Price Trends Post-Halving

Detailed Analysis of Previous Halvings

First Halving: November 2012

- Price at Halving: $12.31

- Peak Price Within a Year: $1,152

Second Halving: July 2016

- Price at Halving: $664

- Peak Price Within a Year: $19,891

Third Halving: May 2020

- Price at Halving: $9,734

- Peak Price Within a Year: $64,863

These historical price movements illustrate a consistent pattern of significant price appreciation following each halving.

Price Movements and Market Sentiment

Market sentiment plays a crucial role in the price movements of Bitcoin post-halving. Increased media attention, speculation, and heightened demand from both retail and institutional investors often coincide with these events, driving prices higher. As Bitcoin approaches its next halving, investors are reminded of historical trends, which can lead to FOMO (Fear of Missing Out) dynamics.

Factors Influencing Bitcoin Price After Halving

Supply and Demand Dynamics

The core principle behind Bitcoin halving is the supply and demand model. By halving the block reward, the rate at which new Bitcoins are introduced to the market decreases, creating scarcity. If demand remains constant or increases, this imbalance can lead to higher prices.

Market Sentiment and Investor Behavior

Market sentiment significantly influences Bitcoin's price trajectory. Leading up to halving events, speculative trading often increases as investors anticipate future price gains. This behavior can create a self-fulfilling prophecy where the expectation of rising prices leads to actual price increases.

External Economic Factors

Bitcoin does not operate in isolation; macroeconomic trends, regulatory news, and global financial conditions also impact its price. For instance, interest rates, inflation rates, and geopolitical events can influence investor behavior, either supporting or hindering Bitcoin's growth.

Bitcoin Price Predictions After Halving 2025

Expert Predictions and Analysis

As we look toward the next Bitcoin halving in 2028, experts have made various predictions about Bitcoin's price trajectory. Notably, Tom Lee from Fundstrat has forecasted that Bitcoin could reach $250,000 by the end of 2025, driven by growing demand from institutional investors and the impact of Bitcoin ETFs.

Influences on Future Price Movements

Institutional Investment and ETFs

The approval and rapid growth of Bitcoin ETFs have made it easier for institutional investors to enter the market. This trend is likely to continue, driving up demand and potentially leading to higher prices.

Regulatory Developments

The evolving regulatory landscape will also play a vital role in shaping Bitcoin's future. Regulatory clarity can instill confidence among investors, fostering greater adoption and potentially boosting Bitcoin's price.

Macroeconomic Trends

Interest rates and inflation are critical economic indicators that influence Bitcoin's appeal as an investment. Historically, Bitcoin has performed well in low-interest-rate environments, making macroeconomic conditions a significant factor to consider.

Conclusion: The Future of Bitcoin Price Post-Halving

Summary of Key Insights

- Bitcoin halving events significantly impact its price due to supply constraints.

- Historical trends show consistent price increases following halvings.

- Market sentiment, macroeconomic factors, and regulatory developments are critical to future price movements.

The Role of Halving in Bitcoin's Market Cycle

Halving events are integral to Bitcoin's economic model, creating a predictable cycle that investors can prepare for. As the next halving approaches, understanding past behaviors and current market dynamics will be essential for navigating the future of Bitcoin.

Key Takeaways

- Bitcoin halving reduces mining rewards, impacting supply and potentially increasing prices.

- Past halvings have historically led to significant price increases, typically within 12-18 months post-event.

- Market sentiment and external economic factors play crucial roles in shaping Bitcoin's price dynamics.

Understanding these elements will help investors make informed decisions as Bitcoin continues to evolve.