Key Takeaways:

- NVIDIA (NVDA) stock has declined over 10% from its recent high, forming a head and shoulders pattern.

- Technical analysts view this pattern as a bearish signal.

- Despite the decline, analysts remain bullish on NVIDIA's long-term prospects.

- Factors such as chip demand and the China trade war are influencing the stock's movement.

- NVIDIA's Blackwell processors and strong profit margins are reasons for optimism.

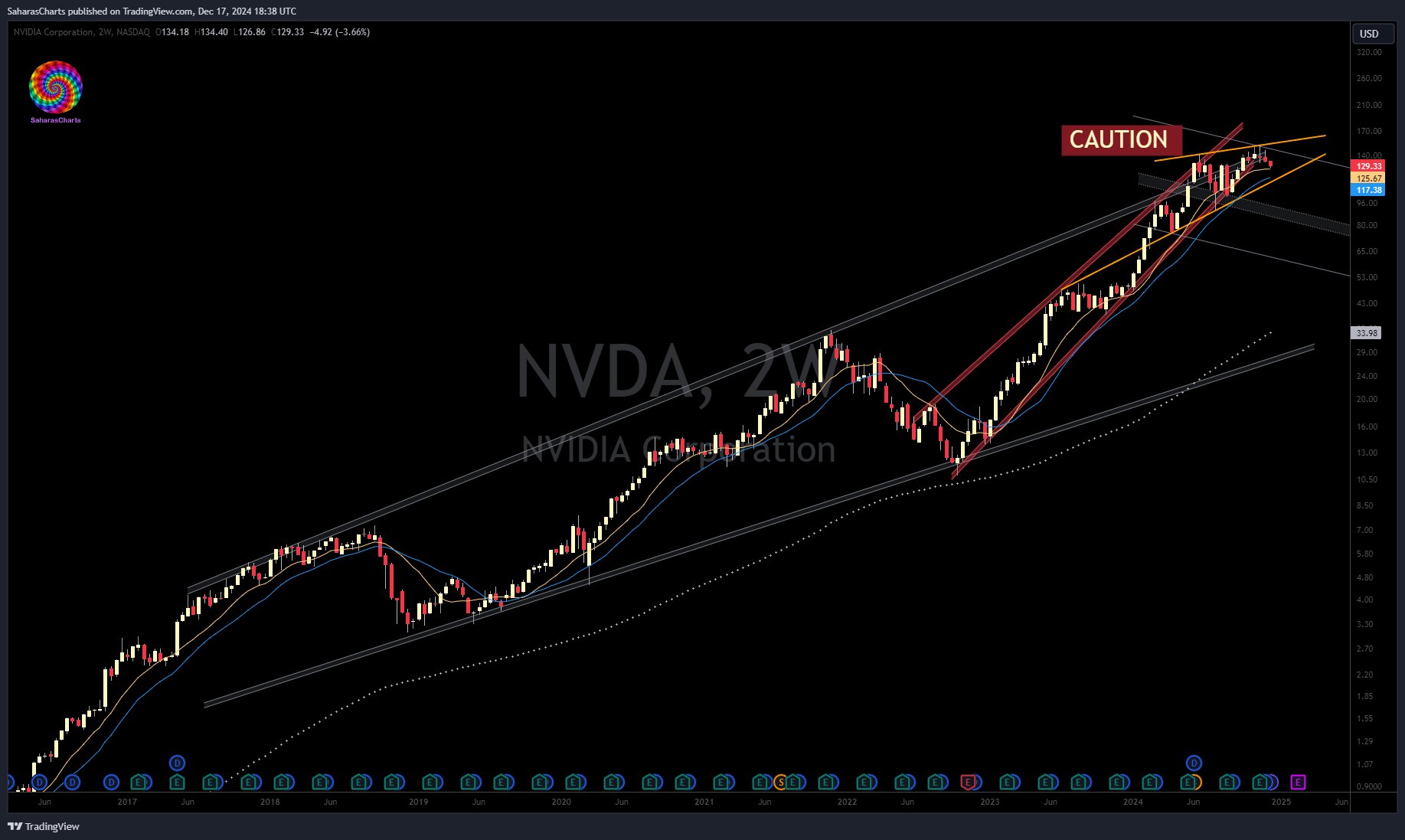

NVIDIA's stock has recently shown a head and shoulders pattern, causing concern among investors. This pattern is often seen as a bearish signal by technical analysts. The stock has fallen over 10% from its peak of around $150 on November 21, dropping below the neckline of $132.

Despite this, the stock has found support at its 100-day moving average. This technical indicator has historically been a point of value for NVIDIA shares. However, there are several factors contributing to NVIDIA's recent stock decline.

One major factor is the perceived easing of chip demand. Microsoft (MSFT), a major customer of NVIDIA, indicated a shift in the supply-demand balance for AI chips. Microsoft CEO Satya Nadella stated they are now "power constrained, not chip supply constrained."

Another factor is the ongoing trade tensions between the U.S. and China. China recently launched an investigation into NVIDIA's acquisition of Mellanox. This is seen as retaliation for U.S. restrictions on selling advanced AI chips to China.

Despite these challenges, there are reasons for optimism regarding NVIDIA's future. Analysts remain bullish, driven by the anticipated success of NVIDIA's Blackwell processors. These processors are expected to dominate the market for AI-powering hardware.

NVIDIA's profit margins are also expected to remain strong, in the low 70% range. This is despite production constraints and supply chain challenges. The company is generating significant free cash flow, with some allocated for share buybacks.

Citi analyst Atif Malik maintains a 'Buy' rating on NVIDIA with a price target of $175. He believes that both GPUs and custom ASICs will coexist in the AI accelerator market. This suggests that NVIDIA will continue to play a significant role in this sector.

If you are interested in learning more about NVIDIA's future, check out our post on Will NVIDIA Stock Keep Climbing in 2025? Here's What Experts Say. Additionally, you can explore our article on 5 Exciting AI Stocks to Watch for Big Gains in 2025.